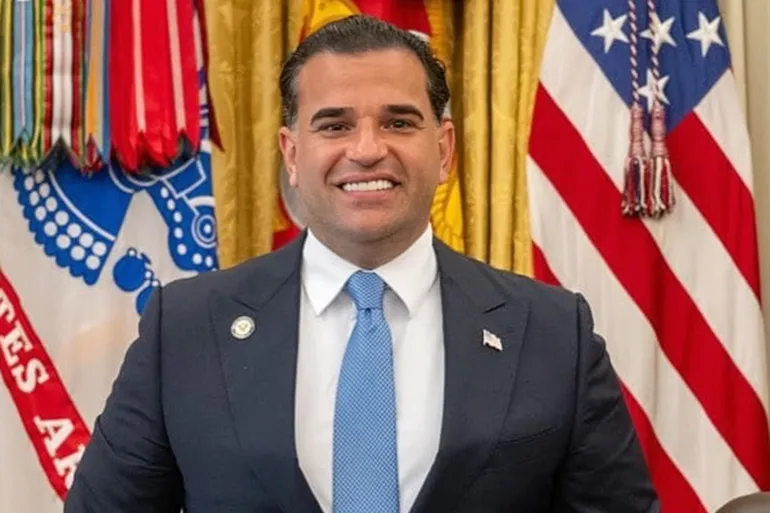

U.S. Special Envoy to Iraq Mark Savaya

US envoy says Treasury reviewing suspected financial fraud and terror-linked contracts in Iraq

BAGHDAD – Mark Savaya, the United States special envoy to Iraq, said Thursday he held discussions with the U.S. Department of the Treasury and the Office of Foreign Assets Control focused on combating what he described as fraudulent financial contracts and illicit transactions in Iraq.

“Today, I met with the U.S. Department of the Treasury and OFAC to address key challenges and reform opportunities across both state owned and private banks, with a clear emphasis on strengthening financial governance, compliance, and institutional accountability,” Savaya said in a statement.

He said the meetings included agreement to review “suspected payment records and financial transactions involving institutions, companies, and individuals in Iraq linked to smuggling, money laundering, and fraudulent financial contracts and projects that finance and enable terrorist activities.”

Savaya said the talks also covered sanctions targeting entities and individuals described as “malign actors and networks that undermine financial integrity and state authority.”

“The relationship between Iraq and the United States has never been stronger than it is today under the leadership of President Donald J. Trump,” Savaya said.

The discussions come amid continued U.S. scrutiny of Iraq’s financial sector. The Treasury Department has previously imposed restrictions on a number of Iraqi banks, limiting their ability to conduct transactions in U.S. dollars, a significant constraint given the dollar’s central role in international trade and finance.

In July 2024, Iraqi Foreign Minister Fuad Hussein met in Washington with Brian Nelson, the U.S. undersecretary of the Treasury for Terrorism and Financial Intelligence, urging a reconsideration of sanctions imposed on 32 Iraqi banks. Hussein said at the time that the institutions had begun a “structural reforms process,” but the restrictions remained in place.

Prime Minister Mohammed Shia al-Sudani also discussed banking and financial reforms with U.S. Treasury officials during a visit to Washington in mid-April 2024. U.S. officials have pressed Iraq to strengthen controls to prevent the smuggling of U.S. dollars, particularly to Iran and allied groups, and to tighten oversight of banks accused of facilitating illicit transfers.

Beyond the banking sector, the U.S. sanctions framework also targets individuals, militia leaders and entities accused of financing terrorism or engaging in activities viewed as destabilizing to Iraq’s economy and state authority.